Delphian Earnings Strategy Series

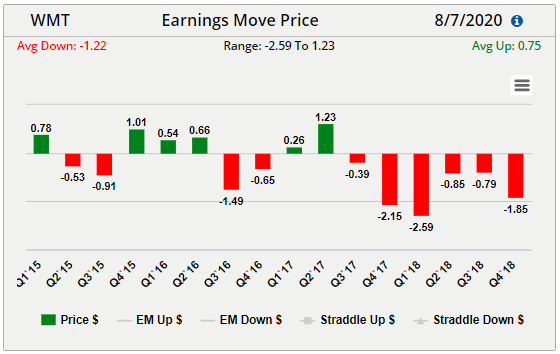

Some company’s earnings reports consistently produce small stock price changes after their earnings announcement.

The price movement historically falls below what the market makers are anticipating, presenting a trading opportunity.

Delphian calls this strategy a Price Non-Mover and uses short straddle, short strangle, iron condor and/or iron butterfly as trade structures.

Walmart (WMT) is an excellent example of a stock that makes minimal price movement almost every earnings announcement.

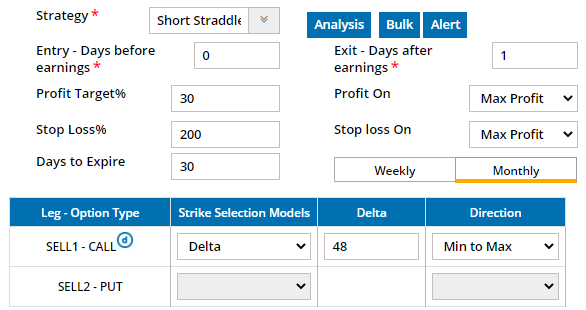

A Price Non-Mover is designed to capture a 15-30% gain for a short straddle, short strangle, iron condor and/or iron butterfly.

The trade is designed to profit on the lack of movement in price immediately after earnings.

The trade is closed when any of the following conditions are met: Profit target is met, stop-loss is met or the day after the earnings release.

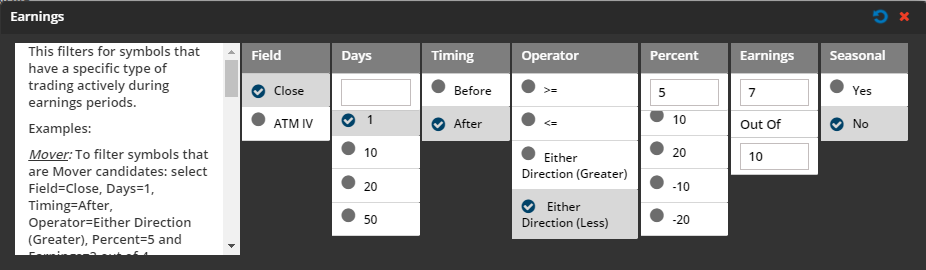

Delphian's default price non-mover criterion involves a price change that is less than or equal to 5% move in either direction from earning’s day to 1 day after for at least 7 out of last 10 earnings reports.

The screener will analyze all historical data and generate a qualifying list of stocks.

The screener criterion can be customized to match an individual’s trading preferences. Any of the fields shown below can be altered to the user’s preference.

Delphian created the Earnings Calendar so users can quickly screen and backtest symbols on one screen.

Symbols can be tested individually or as a group using the bulk testing feature.

All the trading strategy fields shown below are customizable to the user’s preferences.

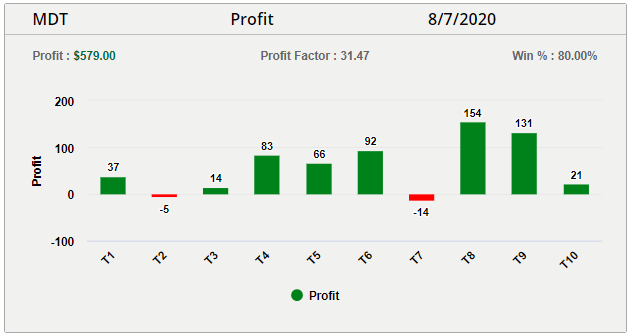

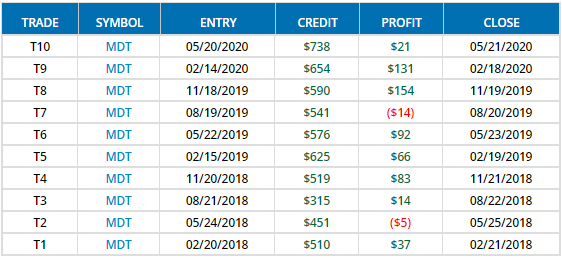

Below are the results of a backtest of a short straddle strategy for Medtronic, Inc (MDT) over the last 10 earnings releases based on entering a trade with the characteristics shown above.

Over the previous 10 earnings, the short straddle position produced a cumulative profit of $579 per contract with a profit factor of 31.47 and a win rate of 80%.

The chart below displays the individual trade results for the analysis on MDT performed above.

Price Non-Mover trades are fairly simple to execute however they are very difficult to find because market makers factor in the expected moves very accurately.

Always test the trade historically prior to executing a live trade to help prevent losses.

Start a trial with Delphian for only $10 and you can receive the Earning Plan for all earning strategies that we provide to our customers each quarter!

Delphian provides predictive analytics for smarter trading. We give traders the necessary tools to increase alpha while reducing risk through the use of our State Modeling algorithm and backtesting platform.