Delphian Earnings Strategy Series

During the lead up to an earnings release institutions anticipate strong results for some companies so they accumulate stock for their funds.

Delphian calls this strategy a Bullish Pre-Runner and based on historical analysis, the price run-ups typically start 5-20 days before earnings.

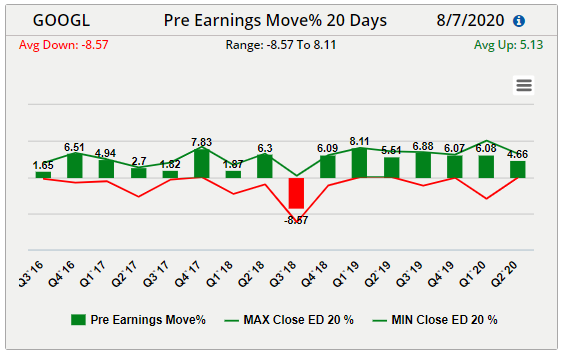

An excellent example of this is Google (GOOGL), within the 20 days prior to earnings it has had an average move up of over 5% for 15 of the past 16 quarters.

The bullish pre-runner strategy tries to capture a 25-50% gain for a long call within the 20-day window prior to earnings.

The trade is closed when any of the following conditions are met: profit target is met, stop-loss is met or the day prior to the earnings release. The strategy uses long calls as the primary strategy as multiple option legs are typically not optimal for the rapid price increase.

Additionally, short strategies like naked puts are risky, as the implied volatility will increase going into earnings, likely negating some of the effects of any price gains.

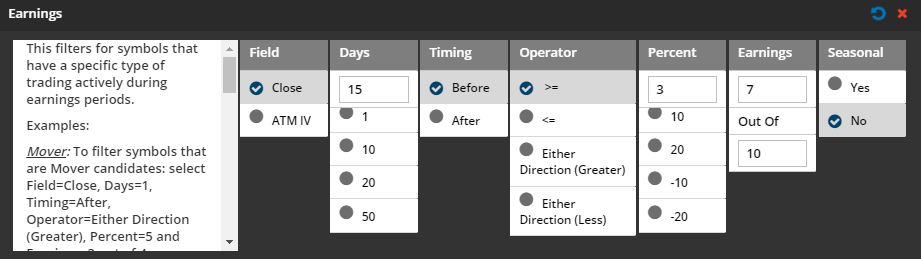

Delphian's default bullish pre-runner criterion involves a price change that is greater than or equal to a 3% from 15 days prior to the earnings announcement for at least 7 out of last 10 earnings reports.

The screener will analyze all historical data and generate a qualifying list of stocks. The screener criterion can be customized to match an individual’s trading preferences. Any of the fields shown below can be altered to the user’s preference.

Delphian created the Earnings Calendar so users can quickly screen and backtest symbols on one screen.

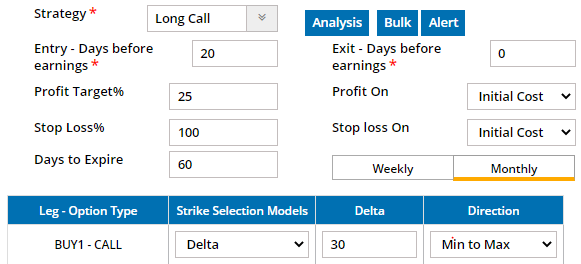

Symbols can be tested individually or as a group using the bulk testing feature. All the trading strategy fields shown below are customizable to the user’s preferences.

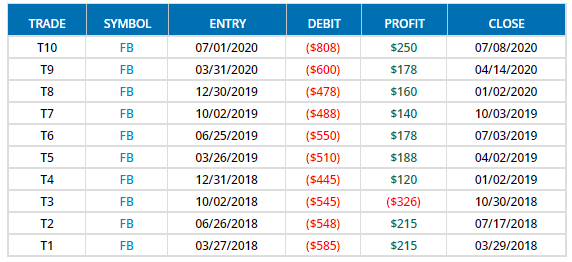

Below are the results of a backtest of a long call strategy for Facebook (FB) over the last 10 earnings releases, based on entering a trade with the characteristics shown above.

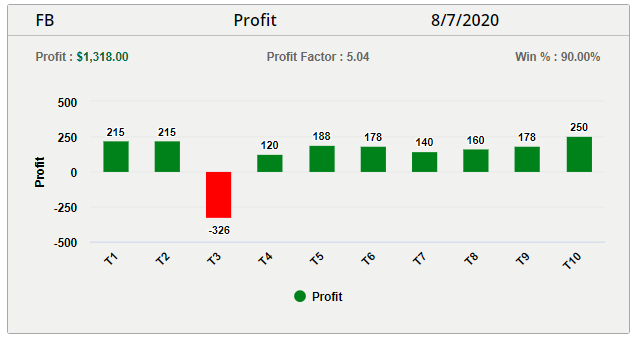

Over the previous 10 earnings, the long call position produced a cumulative profit of $1,318 per contract with a profit factor of 5.04 and a win rate of 90%.

The chart below displays the individual trade results for the FB analysis performed above.

Bullish pre-runner trades are repeatable each quarter and a fairly simple trade to execute. After trade entry, orders can place for profit targets and stop losses so you don’t have to watch the trade constantly.

Start a trial with Delphian for only $10 and you can receive the Earnings Plan for all earning strategies that we provide to our customers each quarter!

Delphian provides predictive analytics for smarter trading. We give traders the necessary tools to increase alpha while reducing risk through the use of our State Modeling algorithm and backtesting platform.