Delphian Earnings Strategy Series

After a company reports earnings the stock price will move in one direction or the other and there will be a sharp drop in implied volatility that triggers a similarly steep decline in an option's price.

The expectations (expected move) for a big stock move were being priced into the options ahead of the earnings report via volatility premiums and after the results are announced that volatility is quickly removed.

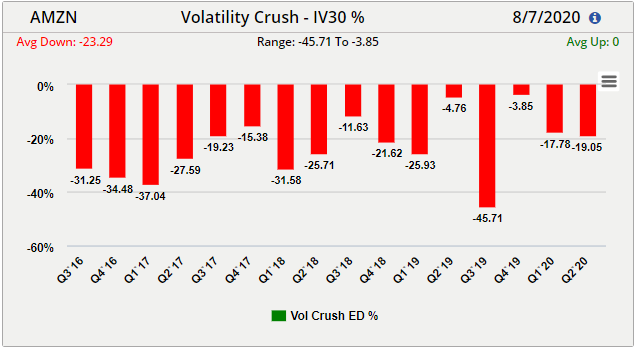

Delphian calls this strategy a Volatility Crush (Vol Crush) and based on historical analysis, the volatility premiums are the highest the day before the earnings announcement.

Amazon.com, Inc. (AMZN) is an excellent example of a stock that consistently experiences high volatility crush after each earnings announcement.

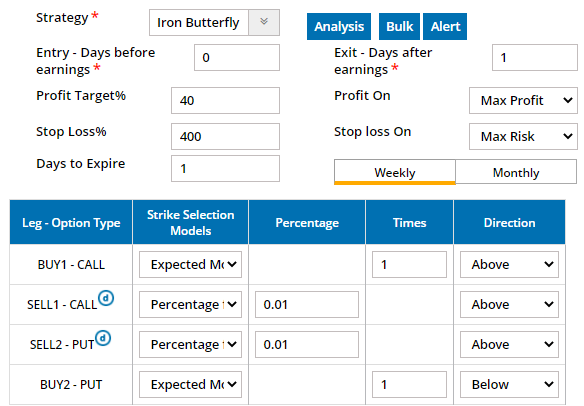

A Vol Crush is designed to capture a 20-40% gain for an Iron Butterfly spread (some note it as an Iron Fly or a Condor); short strangles and short straddles could be used also.

The Iron Butterfly spread has a short call spread and short put spread where the short options are at the same strike and all with same expiration.

The trade is designed to profit from a decrease in volatility and option premiums within the short options immediately after the earnings announcement.

Trades used in this model should be exited the trading day after the earnings release.

The trade is closed when any of the following conditions are met: Profit target is met or the day after the earnings release. Note that there is no stop loss as the risk is defined/limited.

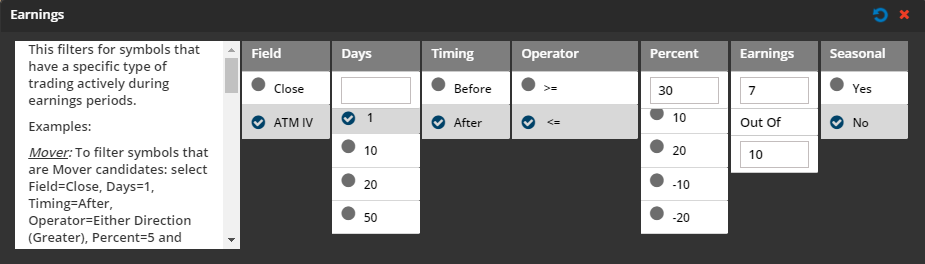

Delphian's default vol crush criterion involves an at-the-money (ATM) implied volatility (IV) change that is less than 30% from 1 day after earnings for at least 7 out of last 10 earnings reports.

The screener will analyze all historical data and generate a qualifying list of stocks. The screener criterion can be customized to match an individual’s trading preferences.

Any of the fields shown below can be altered to the user’s preference.

Delphian created the Earnings Calendar so users can quickly screen and backtest symbols on one screen.

Symbols can be tested individually or as a group using the bulk testing feature.

All the trading strategy fields shown below are customizable to the user’s preferences.

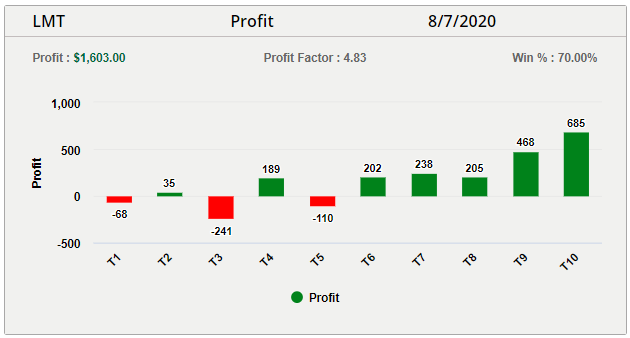

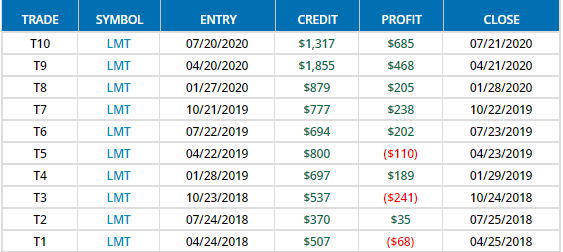

Below are the results of a backtest of an iron butterfly strategy for Lockhead Martin Corporation (LMT) over the last 10 earnings releases, based on entering a trade with the characteristics shown above.

Over the previous 10 earnings, the Iron Butterfly position produced a cumulative profit of $1603 per contract with a profit factor of 4.83 and a win rate of 70%.

The chart below displays the individual trade results for the LMT analysis performed above.

Vol Crush trades are repeatable each quarter. After trade entry, orders can be placed for profit targets. Max loss is calculated before entering the trade, so risk is known prior to trade entry.

The Iron Butterfly is a four-legged option spread and the short options are at the money with a high potential of being in the money after the earnings announcement. Therefore, exercise and assignment of the short, in the money options is possible.

Be prepared to consult your trading broker and have a trading plan in place prior to trade entry.

Start a trial with Delphian for only $10 and you can receive the Earnings Plan for all earning strategies that we provide to our customers each quarter!

Delphian provides predictive analytics for smarter trading. We give traders the necessary tools to increase alpha while reducing risk through the use of our State Modeling algorithm and backtesting platform.